SOURCE:

"Recently, it was reported that US industrial production rose in April for a fourth consecutive month, and owing to a jump in auto assemblies was up 1.1% from March and 6.4% versus prior year. So the usual suspects were out beating the Wall Street tom-toms about economic strength and no recession on the horizon.

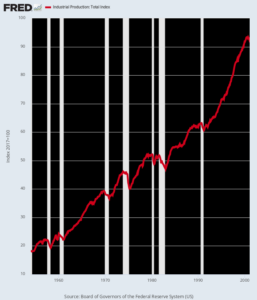

But as demonstrated in the chart below, what we are mainly getting once more is born-again production, not net growth. That is, remove the April 2020 Lockdown swoon and scroll back to the interim high in December 2014 and what do you get?

Well, what you get is a piddling 0.26% per annum growth rate over the past 7.5 years. And for want of doubt, dial back to the pre-crisis peak in November 2007 and you get a per annum growth rate of just 0.21% over the past 14.5 years.

US Industrial Production Index, November 2007-April 2022

So, no, the US industrial economy is not strong—it’s been flatlining for the better part of the current century. And that’s something new under the sun, not in a good way.

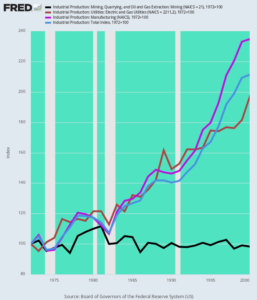

Prior to the turn of the century, in fact, industrial production was the muscular center of the US economy. Between January 1954 and January 2001, total output grew by 3.52% per annum, and that figure is compounded over a 47-year period that experienced seven temporary recessionary setbacks.

Still, industrial production during the period grew nearly 17 times faster per annum than it has since November 2007. We’d say that’s nothing short of a shocker and demands far more serious attention than do some recent monthly deltas from an artificial bottom.

US Industrial Production Index, 1954-2001

When you examine the composition of the historical industrial production data, the cause of the drastic downshift in growth is strikingly evident. The constituent data go back to 1972, but during the next 28-years the manufacturing sector clearly led the industrial growth parade.

Per Annum Growth, 1972-2000

- Mining and Energy: -0.06%;

- Gas and Electric Utilities: +2.45%;

- Manufacturing: +3.10%;

- Total Industrial Production: +2.71%

As is evident above, the only laggard was mining and energy, mainly owing to the fading of the domestic gas and oil industry that could not compete with the low-cost producers in the Persian Gulf, North Sea, West Africa and other newly developed energy provinces.

However, when it came to utility and manufacturing output, growth was robust. The latter remained reasonably competitive in global markets, while the growth of domestic industry and household counts generated steady expansion of gas and electric utility production.

Needless to say, the manufacturing and utility sectors are capital intensive generators of high labor productivity growth and economic value-added. Strong growth at the industrial center of the economy, in turn, spread prosperity to the services periphery and lifted real living standards and sustainable national wealth.

Industrial Production Index And Its Constituents, 1972-2000

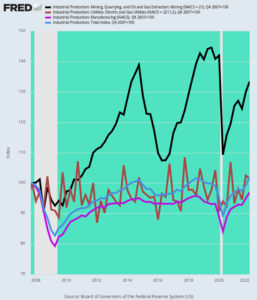

Since the pre-crisis peak in 2007, however, the industrial production picture has turned upside down. The only contributor to industrial production growth since November 2007, in fact, is the mining and energy sector, which boomed on the back of the shale revolution and the availability of cheap investment capital from the speculative precincts of Wall Street.

Per Annum Growth Rate, Q4 2007 to Q1 2022

- Mining and Energy: +2.04%;

- Gas and Electric Utilities: +0.10%;

- Manufacturing: -0.21%;

- Total Industrial Production: +0.14%

That’s right. The per annum growth rate of industrial production (blue line) plunged by 95% during the last 14 years compared to the 1972-2000 average because manufacturing output (purple line) turned negative and gas and electric utility (brown line) growth slowed to a crawl.

With respect to the latter, the abrupt slowdown in the rate of population growth and household formation was a significant contributor to the disappearance of meaningful utility output growth. Thus, during 1972-2001, the growth rate of household formation was 1.68% per annum, which rate slowed by 53% to just 0.79% per annum since 2007.

However, the real culprit in pushing utility output growth to the flat-line was the complete stagnation of manufacturing production.

By Q1 2022, the index for manufacturing output was actually 3% lower than it had been in Q4 2007. And when you toss in energy efficiency improvements in the interim, self-evidently the bottom dropped out of demand for utility supplies from the manufacturing sector.

Industrial Production Index And Its Constituents,Q4 2007-Q1 2022

The question recurs, therefore, as to why manufacturing output growth plunged from +3.10% per annum over 1972-2001 to -0.10% since the pre-crisis peak in late 2007.

The answer, of course, is globalization—the off-shoring of massive amounts of the US manufacturing sector to the cheap labor cost venues of China, Mexico and their global supply chains. That process developed a head of steam in the mid-1990s, when China went all-out building export factories and their supporting infrastructure.

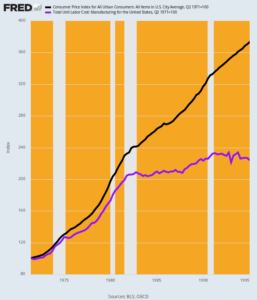

The result, of course, was the greatest labor cost arbitrage in history. Between 1995, when China’s exports to the US began to boom, and April 2022, US nominal hourly wages in manufacturing rose by 103% (brown line, right axis). So doing, they steadily widened the dollar cost gap with China, thereby intensifying incentives for US vendors to off-shore production or sourcing.

At the same time, however, US workers who managed to retain their jobs gained only 6% in inflation-adjusted wages (purple line, left axis) over the same 27 years period.

That is to say, the Fed’s foolish 2.00% inflation targeting policies generated the worst of all possible worlds: While crushing domestic worker paychecks with ever higher inflation, it sent millions of good paying manufacturing jobs abroad. The associated utility growth benefit of robust manufacturing output gains, in turn, also migrated to China, unlike the spillover to domestic utilities, as was the case before 2000.

Indexes of Average Nominal and Real Hourly Earnings, 1995-2022

The breathtaking magnitude of the Fed’s foolish inflation targeting policy is evident when the same facts are viewed from the lens of a sound money regime on the free market. To wit, a dollar-linked to gold would have caused a curtailment of bank lending and credit growth in order to stem the US current account deficits.

In turn, restrictive credit and demand growth would have caused a steady domestic deflation of wages, prices and costs in response to tighter domestic financial conditions. The alternative would have been a massive drain on reserve assets (gold).

As it happened, however, the Keynesian Fed jettisoned the requisites of sound money, which had operated successfully over long stretches of historical prosperity, in favor of monetary autarky, The latter is the foolish belief that it could stimulate the domestic bathtub of GDP to the brim without dislocating the vast flows of US merchandise trade, capital and finances with the rest of the world.

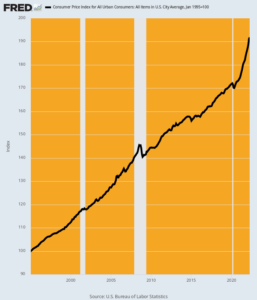

The result was that during the 27 year span shown below, the US price level as measured by the CPI rose by 92%, when under a regime of sound money it would increased by 0.0%, or actually fallen significantly.

The labor and production off-shoring triggered by the Fed fostered inflation shown below, is what brought industrial production growth to a halt, most especially after the Eccles Building went full retard with the printing presses in 2008 and beyond.

CPI Indexed To January 1995

Needless to say, when Mr. Deng pronounced in the early 1990s that “to be rich is glorious”, a US policy of domestic deflation was desperately needed owing to the inflationary follies of the 1970s and beyond. After all, those shiny new export factories, bedecked with state of the art equipment and technology, would be manned by draining a near limitless supply of ultra-cheap labor from China’s massive rice paddies.

In this context, it needs be recalled that between mid-1971, when Nixon shit-canned a sound gold-backed dollar during the infamous Camp David weekend, and January 1995, the domestic price level (black line) rose by a staggering 273%. That obviously levitated the entire domestic cost structure including wages, utilities, transportation and all other downstream activities.

There was not a snowball’s chance in the hot place that productivity improvements could even remotely keep up with these soaring cost pressures. Accordingly, unit labor costs rose by 124% during the same period.

And that’s what sunk US manufacturing. That’s what sent goods production and their utility inputs scurrying to China, Mexico and countless other low labor-cost venues.

CPI And Unit Labor Costs, 1971-1995

The question thus recurs. If all that money printing during recent decades did not boost industrial growth but actually resulted in its off-shoring, pray tell what did it accomplish?

In a word, it caused a vast, capricious redistribution of wealth from savers to borrowers and speculators. And in that there is no economic virtue because the bulk of society did not gain, while the better-off and more aggressive learned that the easy way to wealth is debt and gambling.

In the case of the savers, the data leaves nothing to the imagination. Using a $100,000 savings account at average national rates, the chart below makes evident that during nearly the entirety of this century to date, savers have been underwater: During 17 of the last 20 years, the meager rates shown in the black bars below were less than the rate (blue dashes) needed just to keep up with inflation.

So can you say, wealth confiscation?

That’s what it amounts to because on the free market interest rates on savings accounts would never run below the inflation rates for nearly two decades continuously. And most especially, the conditions extant in 2022 would be considered a laughingstock.

As shown below, to keep up with inflation at present you would need to earn $6,436 in interest annually on that $100,000 savings account, while the actual rate currently on offer amounts to $80 per annum in interest.

Yes, that’s confiscation on steroids. But here’s the thing: The Fed did not actually start letting short-term interest rates off the zero bound until a run rate of $6,356 in stolen funds from savers had materialized; and it intends to take it sweet time over quarters and years getting back to its 2.00% target.

In the meanwhile, of

course, trillions more will have been stolen from main street savers by a

central bank that is in the monetary central planning business, not the

superintendence of sound money.

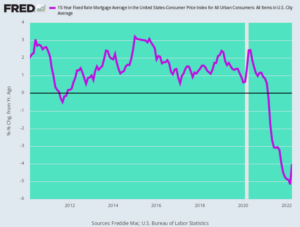

By contrast, mortgage borrowers have been on easy street. Since 2010 the inflation adjusted fixed rate on a 15-year mortgage has oscillated between just 1-2% and by March 2022 when the Fed finally lifted interest rates, it stood at a ludicrous -5.2%.

In a word, until Powell & Co could see the headlights of the inflationary freight train barreling down the tracks straight toward the Eccles Building, they were happily confiscating from savers to the tune of 6.3% in order to pleasure mortgage borrowers with a 5.2% subsidy

For the life of us, we don’t see any Congressional mandate, nor canon of economic logic and justice that could justify such capricious redistribution.

Inflation-Adjusted 15-Year Mortgage Rate, 2010-2022

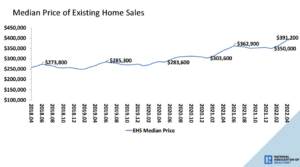

Indeed, the only thing it has accomplished in the housing sector is another home price bubble. Notwithstanding that the 2020-2021 Covid-Lockdowns brought economic calamity to tens of millions of US households and small businesses, home prices shot the moon owing to the Fed’s ridiculously low rates, enforced along the entire yield curve by its manic $120 billion per month of bond-buying.

Consequently, the median existing home price soared from an already frisky $285,300 in mid-2019 to $391,200 at present, representing a 37% gain.

So more caprice: Existing homeowners were tickled pink, while first-time buyers and trade-up buyers had their noses pressed hard upon the glass.

Of course, Housing Bubble 2.0 is about ready to hit the skids. Back in January 2021, the 30–year mortgage rate was 2.65% and average new home price (excluding existing units) was $401,700. By contrast, today the 30–year mortgage rate is 5.30% and average new home price is $523,900.

If you assume a 20% down payment, therefore, the monthly mortgage payment will rise by 80%, increasing from $1,294 to $2,327. Accordingly, already the volume of housing transaction is weakening, meaning that another round of crashing home prices is just around the corner—especially as the Fed is forced to tighten far more than now assumed in order to get the inflation genie back in the bottle.

In a word, what the Fed gaveth, it’s fixing to take back. So what was the point of the cheap-mortgage fueled housing bubble?

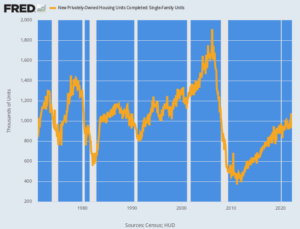

It certainly did not create a corresponding boom in new home construction. As we learned this week, new single family completions in April posted at 1.001 million. That’s 40% below the 2005 peak, and actually below the 1.028 million level posted way back in April 1971.

That is to say, housing completions are now at the level first attained 51 years ago—an interval in which the number of households has risen from 83 million to 130 million. And now home construction is fixing to keel over again as the Fed’s belated rate normalization policy kicks into high gear.

New Single Family Home Completion, 1971-2022

Of course, both Wall Street and much of Washington are already singing from the “Inflation has Peaked” hymn book, but that’s belied by the fact that shelter, food and energy prices are still rising strongly.

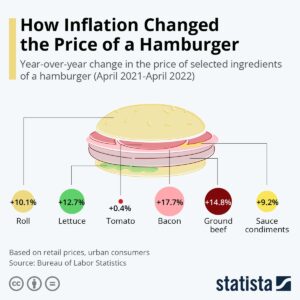

So what the politicians hypocritically call “kitchen table” talk when pretending to empathize with their constituents, might better described as “who mugged the hamburger”?

That’s what the Fed’s massive money printing has actually accomplished over the last several decades.

To wit, no boon to industrial growth, no wealth gains for the majority of Americans accompanied by a perverse redistribution to the top and no gains in housing construction—one of the main reasons for monetary stimulus in times long gone.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.