SOURCE:

Following its worst day on record after Ryan Cohen dumped all his shares (and sold all his calls), Bed Bath & Beyond was battered by more bad news after hours after Bloomberg reports that, according to people familiar with the matter, some suppliers are restricting or halting shipments altogether after the home-goods retailer fell behind on payments.

The retailer has previously said it is struggling with cash and inventory optimization, and ordering missteps appear to have left it with a glut of goods that will have to be sold at markdowns.

Several of the firms that provide credit insurance or short-term financing to vendors have revoked coverage of Bed Bath & Beyond, drastically complicating the company’s scramble for liquidity.

BBBY shares are down a further 4-5% after-hours on the news...

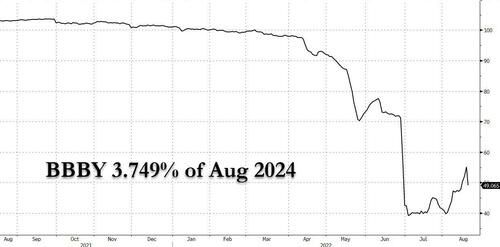

But still have a long way to go to catch up with the reality that bonds have been pricing-in for a while...

As far as stocks go - "mark it zero" comes to mind.

Bonds knew... but the question is - did Ryan Cohen know?

It is only fitting that on the day Blood, Bath and Bankruptcy Bed Bath & Beyond suffered a historic crash in its stock price, we learn from Bloomberg that the quasi-insolvent retailer hired law firm Kirkland & Ellis to help it address a debt load that’s become unmanageable amid a sales slump.

Kirkland, best known for its legal advice in restructuring and bankruptcy situations, was tapped to help the retailer navigate options for raising new money, refinancing existing debt, or both, according to the report. Translation: from $30 yesterday, BBBY stock will be worthless in a few days (just in case there is confusion why Ryan Cohen pulled the plug).

None of this will come as a shock to debt investors, usually far, far smarter then their equity peers, and is why much of Bed Bath & Beyond’s bonds and loans are already trading at distressed levels, even as its stock climbed as high as $30 per share earlier this week.

The share price however tumbled back to $10 after hours on Thursday, after activist shareholder Ryan Cohen dumped his entire stake making $68 million in the process, while costing a similar amount to the thousands of retail investors who followed him into this melting ice cube.

Alas, the stock is going much lower - in fact, $0.00 sounds like support - as the trading prices of the retailer’s debt, have plunged to half their face value or less this year, with the sharpest drop coming after the company announced dismal quarterly earnings June 29. And since the unsecured debt will be impaired, this implies there is zero value for the equity in the upcoming bankruptcy.

If only BBBY had sold stock in an ATM offering at the grotesquely inflated price from earlier this week, to hapless retail investors. That way RC Ventures pump and dump would have been complete.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.