SOURCE:

After surging in June, US durable goods order growth was expected to slow in July (preliminary data) but it notably disappointed with no change from June (vs +0.8% MoM expected), which was revised up from +2.0% MoM to +2.2% MoM. That is the weakest print for durable goods orders since February and YoY growth slowed to just 9.4%

Source: Bloomberg

Ex-Transports, durable goods orders rose 0.3% MoM (better than the +0.2% expected)

The value of core capital goods orders, a proxy for investment in equipment that excludes aircraft and military hardware, rose 0.4% after an upwardly revised 0.9% advance.

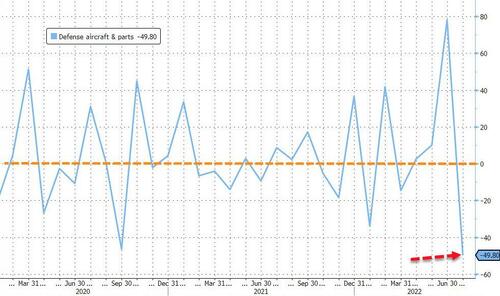

Bookings for defense aircraft and parts plunged nearly 50% - dragging down the overall durable goods measure - the biggest drop since Nov 2019...

Source: Bloomberg

Capital Goods New Orders Nondefense Ex Aircraft & Parts - a proxy for capital expenditure - was up solidly in the early July data (+0.4% MoM vs +0.3% MoM expected)

Of course, all of this data is nominal - not adjusted for inflation - so adjust your euphoria at the 'economic' strength accordingly.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.