SOURCE:

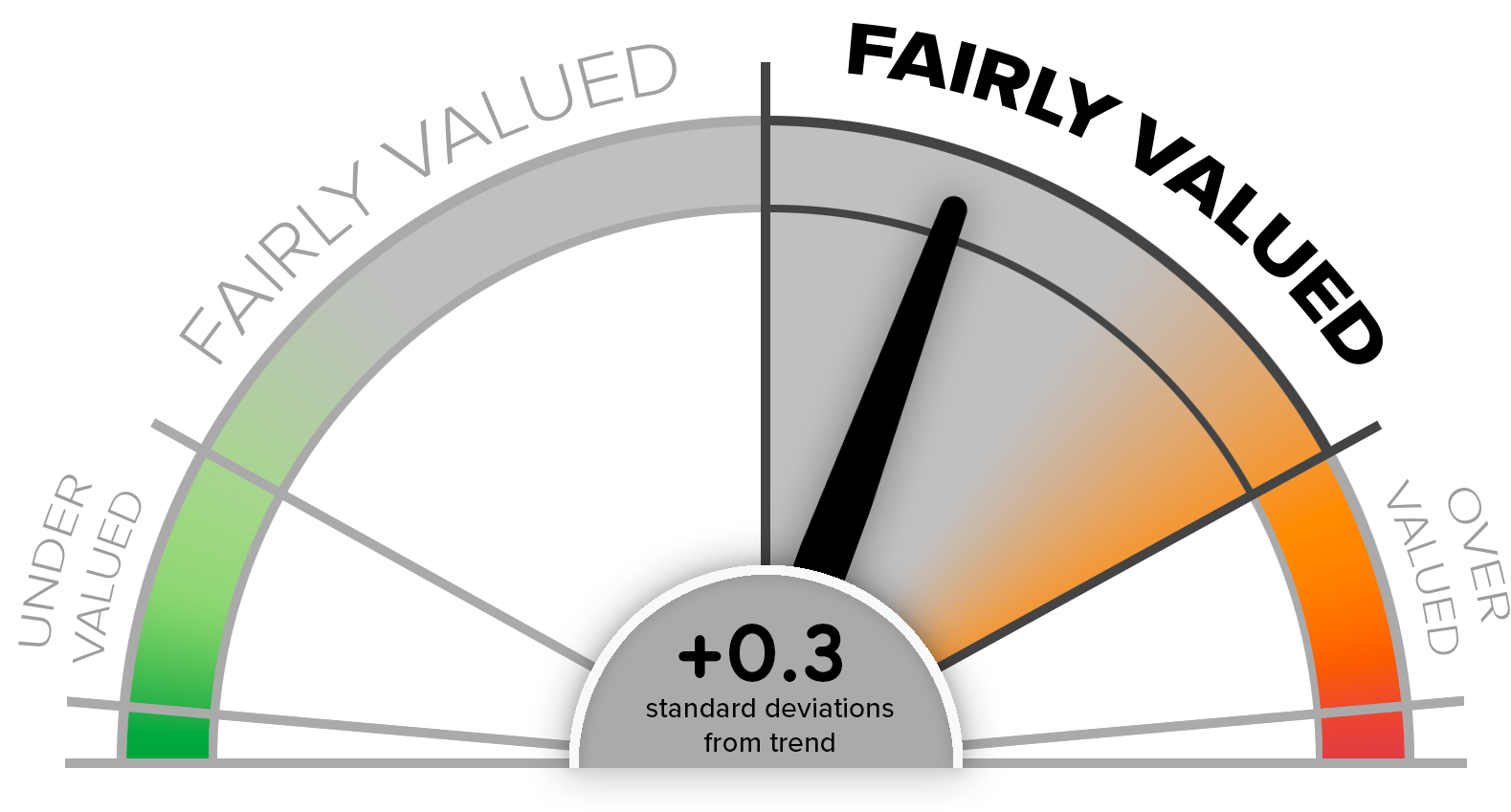

Current Market Valuation

Aggregate index score shown is the equally weighted average of our six core valuation models, shown below. Each model in the index uses historical data to determine a baseline. Current model values are expressed in terms of the current data's number of standard deviations above or below that baseline trend.

Updated September 23, 2022

Models are updated at end of each week, or as data becomes available. For much more detail on each model, click into their respective detail pages, below.

Core Valuation Models

The Yield Curve Model: Fairly Valued

Updated September 22, 2022

Summary: When short term (3-month) Treasury yields are higher than long term (10-year) yields, it is a bearish signal that is almost always followed by economic recession.

Currently: The 10-year Treasury rate is 3.70% and the 3-month is 3.19%, for a spread of 0.51%. Since 1950 the historic average spread has been 1.51%. The current spread is 0.8 standard deviations above the historic trend. We consider this Fairly Valued.

The Buffett Indicator Model: Fairly Valued

Updated September 23, 2022

Summary: The Buffett Indicator is the ratio of the total value of the US stock market versus the most current measure of total GDP.

Currently: The total US stock market is worth $39.5T, the current GDP estimate is $24.9T, for a Buffett Indicator measure of 159%. This is 0.8 standard deviations above the historic trend of 128%. We consider this Fairly Valued.

The Price/Earnings Model: Fairly Valued

Updated September 23, 2022

Summary: The PE Ratio Model tracks the ratio of the total price of the US stock market versus the total average earnings of the market over the prior 10 years (aka the Cyclicly Adjusted PE or CAPE).

Currently: The current CAPE ratio is 27.1. This is 35% above the long-term historic trend CAPE of 20.1, or approximately 0.9 standard deviations above trend. We consider this Fairly Valued.

The Interest Rate Model: Fairly Valued

Updated September 23, 2022

Summary: Low interest rates should generally drive higher equity prices. This model examines the relative S&P500 position given the relative level of interest rates.

Currently: The current S&P500 ($3,693) is currently 0.7 standard deviations above its historical trend. The 10-year US Treasury interest rate is 3.70, about 0.7 standard deviations below trend. Netted together, this composite model suggests the total market is Fairly Valued.

The Margin Debt Model: Undervalued

Updated August 31, 2022

Summary: Margin debt is money investors borrow to invest in stocks. High margin indicates bullish investors, and tends to lead stock market corrections, particularly after margin rates begin falling from a peak. This model looks at changes in margin as a percent of total stock market value.

Currently: As of August 31, 2022, total US margin debt was $688B, a decrease of $299B year-over-year. This represents a yearly decrease of 0.74% of the value of the total US stock market. This is about 1.1 standard deviations below the historical trend, indicating the market is Undervalued.

S&P500 Mean Reversion Model: Fairly Valued

Updated September 23, 2022

Summary: An extremely straightforward model stipulating that at some point, eventually, the S&P500 will tend to return towards its historic trend line.

Currently: The S&P500 is at $3,693, or approximately 24% above its exponential historic trend line. We consider this Fairly Valued.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.