SOURCE:

EU NatGas Prices Jump As Plan To "Fix" Energy Crisis Underwhelms | ZeroHedge

European nat gas prices jumped this week as the market's initial euphoria and apparent confidence that Europe's "emergency fix" to contain the energy crisis is big on jawboning and weak on... well... actually "fixing" the crisis.

EU benchmark futures have been on a tear after bottoming around 182 euros a megawatt-hour. Since Tuesday, prices have jumped 32% to 242 euros as traders aren't convinced last Friday's meeting among 27 EU energy ministers is enough to starve off a crisis in the months ahead. However, prices faded in the late Thursday session.

We reported on Tuesday, right around the time EU NatGas bottomed, that the only thing the energy ministers "agreed on was implementing a ceiling on the revenues of power utilities that do not use NatGas to generate power."

OilPrice's Irina Slav pointed out there was more disagreement than agreements among the energy ministers. She explained:

"What they did not agree on was everything else the Commission suggested last week, including a price cap on Russian gas, a cap on final energy prices, and a direct intervention in EU electricity markets. It's hard to get 27 countries to agree on so many things without any compromise. This is why the EU's survival plans for the winter may never work as intended."

The EU's 140 billion euros plan also includes bailouts for energy companies and provides payment assistance to households and businesses -- but does very little on how to address immediate new sources of NatGas in an environment that is tighter than ever as Nord Stream 1's supplies from Russia to Europe have fallen to zero.

"The fact that they've gone quiet on the gas price cap is taking some risk out of the market," said James Huckstepp, head of EMEA gas analytics at S&P Global Commodity Insights. "And the plans to subsidize end-users is bringing demand destruction assumptions into question."

Less than a week after the meeting, the German government warned Thursday that the threat of energy rationing in Europe is still increasing, and there will likely be NatGas shortages.

"I expect waves: there are gas shortages, they go, they come back, they appear here, sometimes there, possibly throughout Germany," Klaus Mueller, president of the country's energy regulator, said. "If we get a very cold winter, we have a problem."

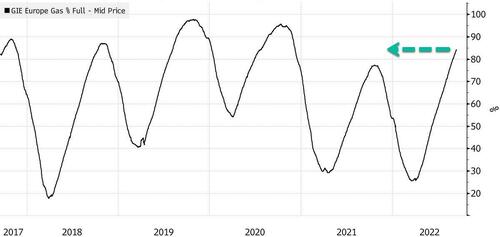

Bloomberg pointed out that all eyes will be on the EU's NatGas storage levels. The good news: storage is about 84%, above a five-year average, and Germany is at 89%, according to Gas Infrastructure Europe.

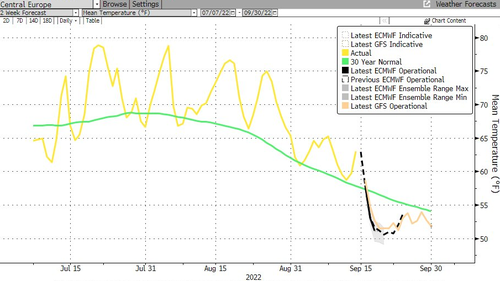

Weather will be a significant factor as Central Europe's average temperatures have been sliding since September, indicating cooler temperatures could increase heating demand by the end of the month.

"Europe will start seeing some heating demand picking up now," said Niek van Kouteren, a senior trader at Dutch energy company PZEM NV. "If we do see a prolonged colder period though, that will really start impacting prices, and you might already have to start withdrawing some storages."

Without drastically increasing new NatGas sources, EU leaders will have to continue enforcing mandatory electricity curbs on peak power demand periods.

EU NatGas storage levels and weather conditions will be closely watched. A major problem will materialize if the continent has a freezing and prolonged winter.

Europeans probably wish they had more global warming to avert an energy crisis.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.