SOURCE:

"Horrendous" CarMax Results Confirm Fed Has Successfully Pushed US Economy Off A Cliff | ZeroHedge

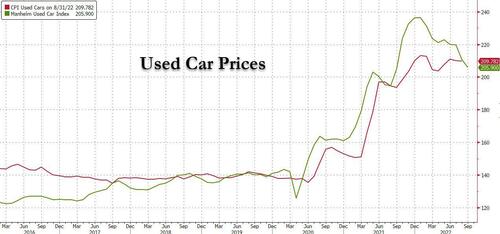

So much for that used-car price bubble, one of the main drivers - pardon the pun - behind the inflationary surge of 2022.

Shares of US auto dealers cratered today after CarMax’s Q2 reported catastrophic results which wildly missed estimates, sparking concern about the whole group.

EPS of only 79c, almost half the $1.40 consensus estimate, shocked markets, while net sales of $8.14 billion also missed expectations. The stock lost a quarter of its value on Thursday.

A soundbite from the Vital Knowledge newsletter set the tone: it said that KMX “horrendous report” was bad for the stock and autos, but would be welcomed by Fed Chair Jerome Powell as proof the Fed has successfully pushed the economy into a recession. That's because vehicle affordability issues stemmed from inflationary pressures, higher interest rates and low consumer confidence.

On the other hand, the results will exacerbate concern about the automotive industry. Indeed, the entire US automotive industry is being hammered by soaring interest rates and a stretched consumer. GM and Ford are also among the biggest decliners with Ford warning last week on inflation costs.

The silver lining: used car prices - which as noted above had an outsized contributed to high inflation - are finally tumbling as the next Manheim Used Car index update will undoubted show. But, as Bloomberg notes, the overall pain in a cyclical industry will outweigh that point. The auto complex and cruise lines (another consumer proxy) made consumer discretionary the worst performer in early US trading. Tech and real estate continue to get smacked by rising yields. This is just the latest confirmation that crushing inflation comes at a cost, which is usually a collapse in demand and a recession.

There was another silver lining: since it was unbridled consumer spending (thanks trillions in Biden stimmies) that prompted the Fed's erratic response to crush the economy, observing first hand just how hard the US consumer is being crushed by soaring rates (as a reminder, the average mortgage just rose above 7% for the first time in 22 years earlier this week), may finally force the Fed to recognize that nuking inflation in a world where there is nothing more than smouldering, recessionary rubble, may not be the best strategy.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.