SOURCE:

Navigating the Pain of Your First Bear Market (awealthofcommonsense.com)

Navigating the Pain of Your First Bear Market

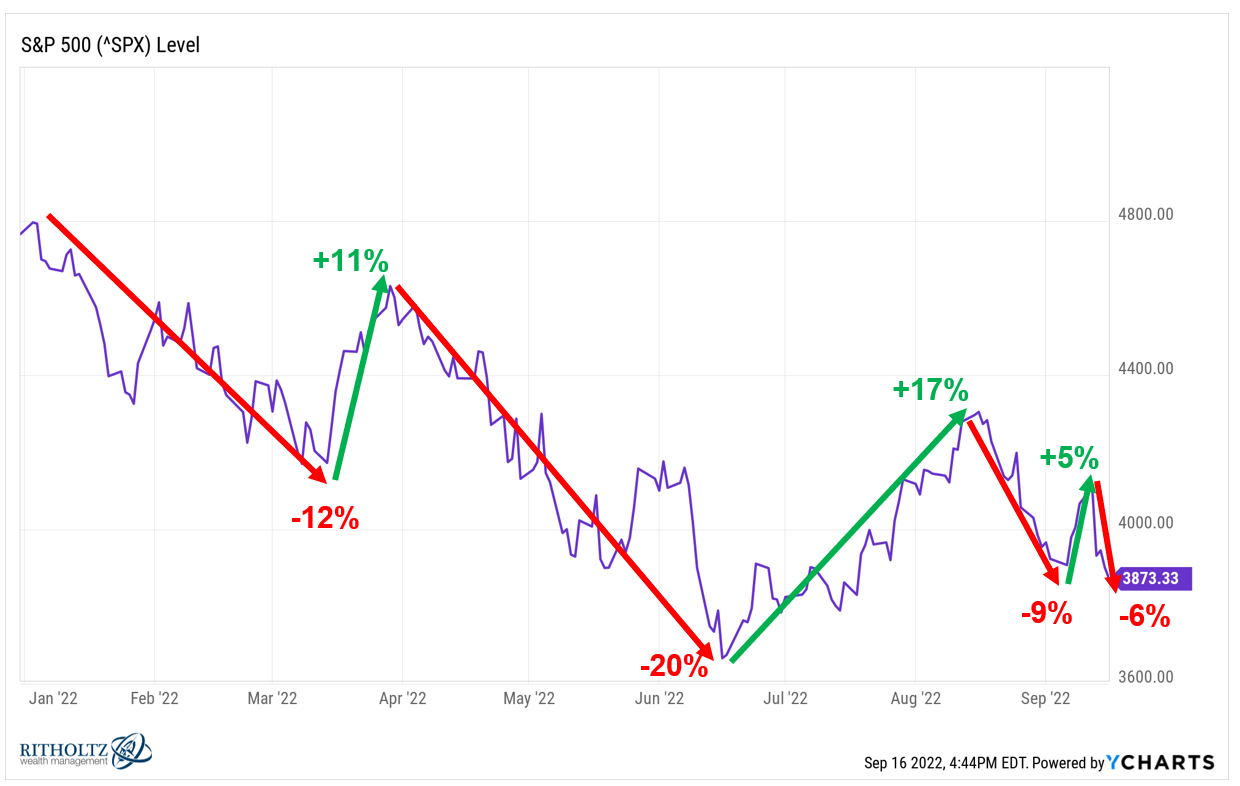

Earlier this week I posted a chart showing how volatile the stock market has been this year:

Things have gotten even more volatile since then.

This post prompted the following response from someone on Twitter experiencing their first bear market:

Yes, there is precedent for this.

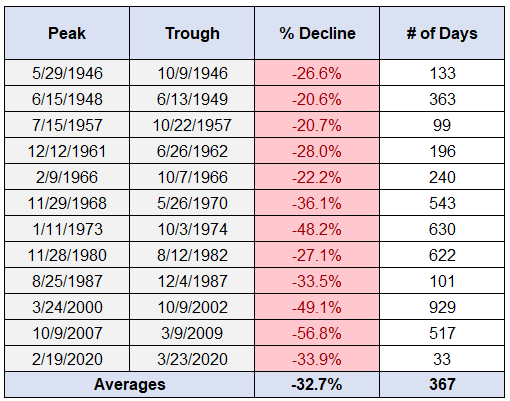

These are all of the bear markets since World War II:

If anything, it’s surprising the current iteration isn’t down more.

Inflation is raging at 40 year highs. Interest rates are rising at their fastest pace in history. Federal Reserve officials are actively rooting for the stock and housing markets to crash. The Fed is trying to orchestrate a recession.

Yet the S&P 500 is down just 21% or so from its all-time highs. That’s not even an average bear market.

Maybe we have further to fall. Maybe not. But either way, if you’re going to invest in stocks you have to get used to this.

Here’s what I wrote in my most recent book about how I think about downturns:

In the coming 40-50 years I’m planning on experiencing at least 10 or more bear markets, including 5 or 6 that constitute a market crash in stocks. There will also probably be at least 7-8 recessions in that time as well, maybe more.

Can I be sure of these numbers? You can never be sure of anything when it comes to the markets or economy but let’s use history as a rough guide on this. Over the 50 years from 1970-2019, there were 7 recessions, 10 bear markets and 4 legitimate market crashes with losses in excess of 30% for the U.S. stock market. Over the previous 50 years from 1920-1969, there were 11 recessions, 15 bear markets, and 8 legitimate market crashes with losses in excess of 30% for the U.S. stock market.

Every one of those bear markets and recessions were unique in their own way. This one is unlike anything we’ve ever seen before when you throw in the pandemic, government spending spree, negative interest rates, supply chain shocks and such.

Markets are constantly changing and evolving over time. In some ways, it’s different with every bear market.

In other ways, it’s the same every time, especially when it comes to human nature which is the one constant throughout history.

Every bear market causes feelings of panic and despair. They make you question your previously held investing beliefs. They force you to consider whether or not you have the intestinal fortitude to stick with your long-term investing plan.

I’m not going to sugarcoat it for you — bear markets are painful. Every single one of them (even if you’ve experienced a handful in the past).

But if you’re a young investor, today’s situation is much better than where we were 9-18 months ago.

The S&P 500 is now down a little more than 20%. The Russell 2000 is down almost 30%. The Nasdaq 100 is down more than 30%.

Stocks are on sale. They could get marked down even further but I don’t think too many young people are going to regret buying stocks right now when they look back in 15-20 years.

Can you believe where you could have bought stocks in 2022? someone is bound to say in the 2030s when millennials are in their peak earnings years and gobbling up stocks.

Not only are stock prices lower but you can finally earn some yield on your cash.

For years I’ve been bombarded with questions from young people about where to stash their cash while they save for a down payment or wedding or emergency fund when there was no yield to be had.

Guess what?

We finally have some yield!

Short-term treasuries are now yielding 4%. That means higher rates on savings accounts, CDs, money markets and short-term bond funds.

Prices are down for financial assets but expected returns are rising.

As long as you’re making regular contributions to your retirement account, brokerage or savings account, the situation has improved this year.

It doesn’t feel like it because everyone is very angry right now with the combination of high inflation and rapidly rising interest rates.

It’s difficult to ignore all of that negativity so the best option for young people is to automate as much of the investing process as you can.

Automate your savings so you don’t have to think about it. Automate your retirement contributions so you don’t allow bad days or months to affect your multi-decade time horizon. Automate your investment purchases on a periodic basis so you’re not tempted to time the market.

The more good decisions you can make ahead of time the easier it is to avoid the painful emotions that are brought about by the inevitable bear markets.

Things could get worse before they get better.

If you’re a net saver in the years ahead, that’s a good thing.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.