SOURCE:

Will the Stock Market Fall if Earnings Fall? (awealthofcommonsense.com)

One of the worst parts about any bear market is it feels like there’s always something else to worry about that hasn’t even happened yet that could make things even worse.

The future risk everyone has had on their market bingo card for months and months now is a recession caused by the Fed.

If we do get a recession anytime soon it will certainly be the most obvious recession in history that everyone predicted in advance.

With the high possibility of a recession looming the next logical step for many market observers is to predict the downfall of corporate earnings.

Corporate earnings have held up pretty well this year but certainly, they would fall if we go into a broad economic slowdown right?

This makes sense to me.

Stock market valuations are almost always some function of price to another variable. Price to earnings. Price to sales. Price to cash flows.

Sure, the price has already come down but what happens when the earnings, sales and cash flows come down next? The stock market will surely fall further, right?

It’s possible but the relationship isn’t quite so clear with these things.

Over the very long-term the stock market is driven by fundamentals such as earnings, dividends and cash flows. But even over decade-long time frames, those fundamental drivers don’t always have the impact you would assume.

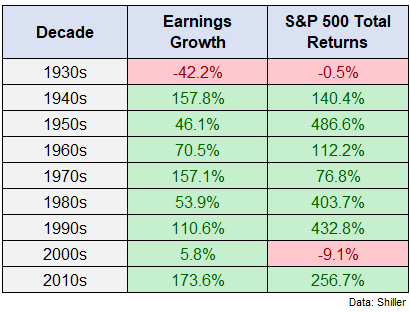

Using historical data from Robert Shiller, I looked at earnings growth by decade compared to total returns for the stock market:

There are times when these things line up. Earnings growth was horrendous in the 1930s and 2000s and so was the stock market.

Earnings growth was lights out in the 1940s, 1990s and 2010s and the stock market followed suit.

But look at the 1970s — amazing earnings growth with poor stock market performance. Earnings didn’t grow all that much in the 1980s but the stock market blasted higher. The same was true in the 1950s.

There are far more variables at play when it comes to stock market performance than just earnings.

The same is true over shorter time frames.

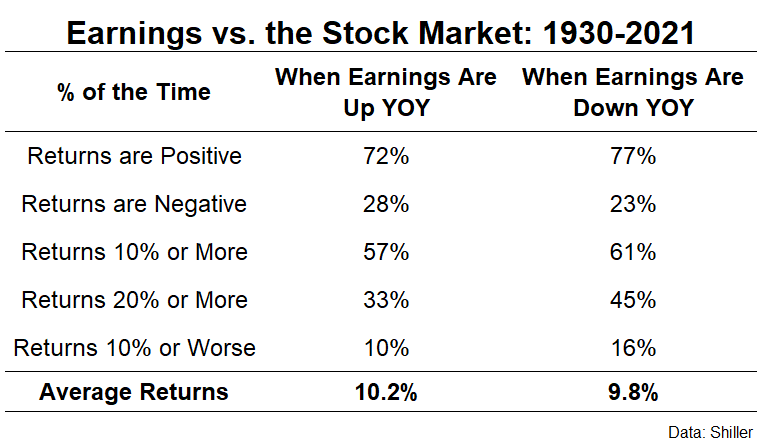

Between 1930 and 2021, S&P 500 corporate earnings were positive from year to year 61 times and negative 31 times.

So two-thirds of the time earnings were growing and one-third of the time earnings were shrinking. This makes sense when you consider the stock market is positive roughly 3 out of every 4 years, on average.

The tricky part here when trying to use earnings to handicap the stock market is the ups and downs don’t always line up perfectly.

If you were only to invest in the stock market when earnings were up year-over-year your average annual return would have been 10.2%.1

This makes sense. When earnings are strong you would expect stocks to be strong.

However, if you were only to invest in stocks when earnings were down year-over-year your average annual return would have been 9.8%.

This doesn’t seem to make sense but the stock market isn’t always logical. Sometimes it overreacts. Other times it underreacts. Sometimes it front-runs the future. Other times it lags behind what’s coming next.

If we drill down into the performance during positive and negative years for earnings it doesn’t really clear things up either:

Over the last 90+ years the stock market has been more likely to see positive returns, double-digit returns, and up years of 20% or more when earnings are down from one year to the next. The market was also more likely to experience a double-digit loss but not by much.

To be fair, the biggest bear markets in history have coincided with the biggest declines in earnings.

It is possible that an earnings recession will lead to another leg down in the stock market.

But it’s certainly not a foregone conclusion.

The stock market cannot predict the future but it’s hard to believe the current bear market isn’t at least taking into account the potential for lower earnings.

Figuring out what’s priced into current levels is never easy so it’s difficult to say what the market expects to happen to earnings if we do go into a recession.

Even if you know what will happen to earnings in the coming years it might not help you predict what will happen to the stock market.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.