SOURCE:

US nominal yields are quite the rage these days.

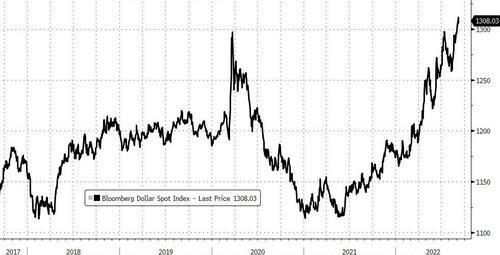

And the dollar is having a heyday like no other, with the yen, the euro and the pound desperately in need of some smelling salts - except that there is just no one to nurse the non-dollars back to health in quick order.

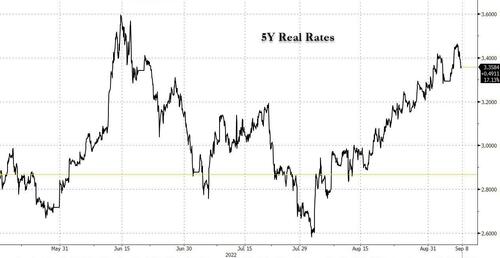

Underpinning the inexorable increase in dollar-denominated nominal yields and the chutzpah in the greenback is, of course, the surge in inflation-adjusted yields in the state-side.

Five-year real rates have shot up some 100 basis points in the space of just over a month, and so have 10-year rates - more or less.

And yet it doesn’t look like we are almost there when it comes to the end of possible strength in the dollar and the surge in nominal rates.

Witness Fed Richmond President Thomas Barkin remarking that the “destination is real rates in positive territory and my intent would be to maintain them there until such time as we are really convinced that we put inflation to bed.”

That, of course, means that after spades of tightening so far this year, the Fed is still nowhere in sight of Destination Restrictive Territory.

If the Fed was naive (or artful enough to make everyone buy the story) in projecting just 75 basis points of increase for all of 2022 at the end of last year, now the boot is fully on the other foot.

Having already raised rates by 225 basis points, the prospect of taking it higher by another 150 basis points in short order is now more or less the base case.

On the other side of the pond, the European Central Bank is prepared to be more hawkish than even real hawks that spread their wings and soar over the sky... and that means euro-area rates are going to end up a lot higher this year than anyone imagined.

Still, that’s not to say that President Christine Lagarde and her governing council will be able to match Chair Jerome Powell and Co. in their fire power. And that will still mean vulnerability for the euro.

And we haven’t even mentioned the Bank of Japan’s nonchalance amid all this tumult, which of course leaves the yen exposed toward 150 per dollar.

And there is no need to shed a tear for the pound.

If you are going to fiddle as London burns and inflation comes scorching down, you could hardly persuade currency traders to accept deeply negative real yields as compensation and put up with it with a happy face.

It just ain’t happening, Mr. Andrew Bailey, unless the Bank of England decides to amuse everyone with fairy tales. Not that anyone is in the mood for it...

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.