SOURCE:

Two months ago, when stocks were still sliding ahead of the mid-summer bear market meltup, we looked at investor sentiment and found that retail (as well as institutional) investors were in the process of capitulating.

This capitulatory sentiment quickly reversed however, once stocks first rose above 4,000, then the 500% retracement and eventually were on the verge of breaking above the 200DMA... but failed and have since stumbled again dragging everyone's mood along with them.

So fast forwarding two months, and taking another look at sentiment again, it would be safe to assume that with stocks sliding, that the mood has once again turned dire. And sure enough, as Vanda Research observes in its latest weekly note (available to pro subscribers), speculative retail traders are throwing in the towel.

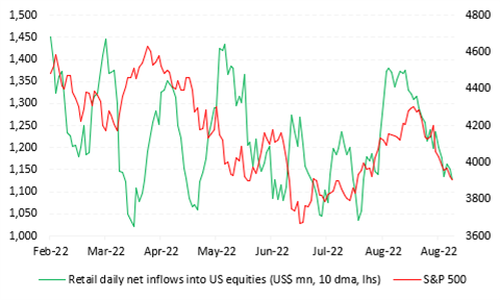

As Goldman's Michael Nocerino wrote in his market wrap, saying that the bank is "seeing the absence of the retail investors (just look at bitcoin/meme stocks) as it’s back to school/work", Vanda Research confirms that retail investors’ inflows into US securities continue to drop as the sell-off deepens, and suspects that "the lack of buying is originated from the increasing risk aversion of retail traders – who are waiting for a more favorable environment before trying to time the market or pick new stocks." Translation: it makes no sense to buy the dip if tomorrow a bigger dip will emerge.

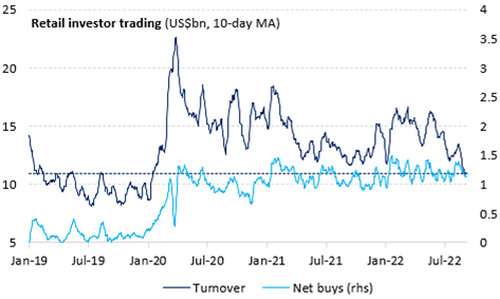

The lack of retail engagement can be observed by the low turnover (in line with 2019 levels). At the same time, individuals with a long term investment horizon are still net bullish – and indeed, net purchases remain relatively strong, close to the 2020-2022 average.

That said, Vanda expects the retail inflows to slow further if equities continue to fall – especially if the sell-off is driven by the underperformance of mega-caps.

A better indicator of retail capitulation comes from Vanda's tracker of total retail investors’ traded value in US securities, which has dropped to pre-Covid levels, or around $11BN per day...

... and while net inflows have also been dropping, they remain in line with the post-Covid average. Vanda believes that this discrepancy is due to a change in investors’ behavior, as most of the active retail speculative investors gave up on day trading and now prefer to wait for a change in the macro-economic conditions. On the other side, a large portion of retail traders buy the dip with ETFs or favorite stocks in auto-pilot as they have a long term investment horizon.

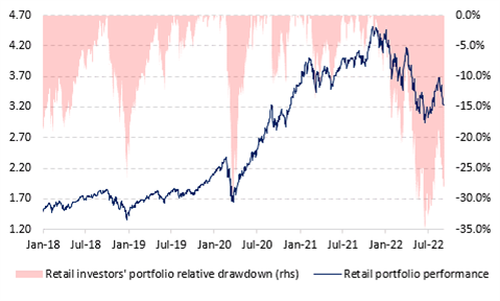

Of course, when one cuts to the chase, sentiment is always just a function of price, which is a problem since the average retail investor's portfolio drawdown is again approaching -30%. As a result, risk-aversion is likely to only pick-up as the YTD PnL dramatically declines.

In this context, Vanda thinks that the main risk on the downside is an underperformance of mega-caps - as retail investors are heavily exposed to stocks like: AAPL, TSLA, AMZN and NVDA; the retail tracking company expects portfolios to experience large losses if these companies underperform over the next few weeks which could eventually lead to a full-scale capitulation.

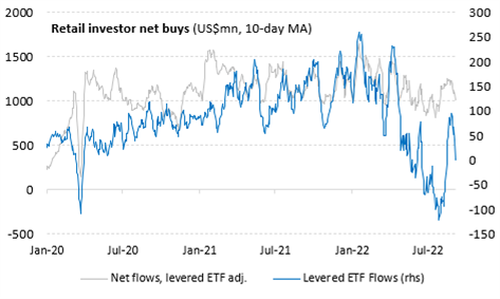

Another pattern that reinforces this bearish view is the recent drop in levered long ETFs net inflows. After an initial rebound in TQQQ purchases during the first stage of the sell-off, which started with the Jackson Hole symposium, Vanda noticed a sharp decline in net inflows. Probably, retail traders do not dare to bet on a quick rebound – or they even added bearish positions by buying SQQQ (most bought security yesterday).

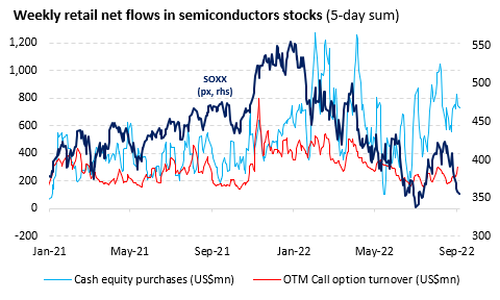

A more granular look at retail flows finds that investors’ flows into semis stocks show resilience as the US unveils the details of its Chips plan. One possible catalyst is the signing of the $52BN Chips for America plan into law on 9th August. The package is expected to funnel more than $70bn into the US semiconductor industry and set aside approximately $200bn for scientific and technological research. However, shares of semiconductor stocks (SOXX) have shed more than 16% since mid-August, lagging broader US equity indices as Fed tightening and global slowdown fears dominated headlines. Nevertheless, as the charts below show, the recent slump hasn’t deterred retail investors who have continued to step up buying in both cash equity and options markets ($730MM and $310MM in the last five trading days, respectively).

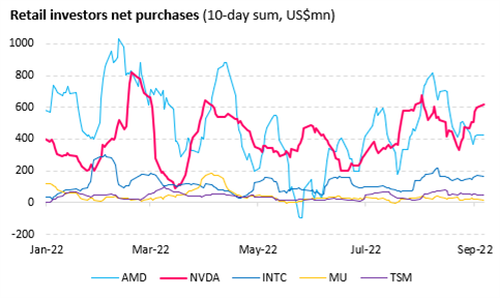

Interestingly, despite its recent woes, NVDA remains a retail favorite within the semiconductor universe, with over $600MM net retail flows over the past two weeks. The stock has now slid 29% since the disappointing earnings pre-announcement on August 8th. The move was likely also driven by worries about the knock-on impacts of the CHIPS bills on its sales to China. According to Bloomberg data, the stock derives around 57% of its revenue from China and Taiwan, but that doesn’t seem to worry retail investors much as they continue offering exit liquidity to the pros.

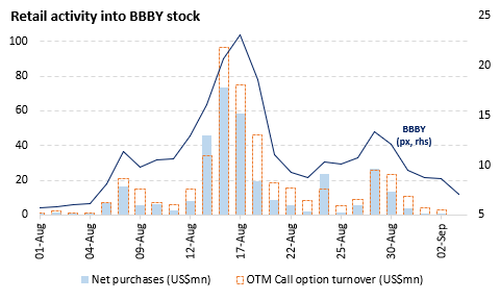

One place where the retail mania has certainly burst is Bed Bath stock - here, retail investors appear to have abandoned this summer phenomenon stock entirely as the company announced plans to lay off 20% of staff and close 150 stores, and following the sudden death of its CFO. That said, sporadic bursts in the trading of meme stocks will remain a feature of equity markets in the future. However, repeated attempts have displayed a decreasing impact on overall markets over time as investors of all stripes have learned how to navigate these highly speculative events. In particular, meme stock trading phases are shorter and unsustainable during bear markets.

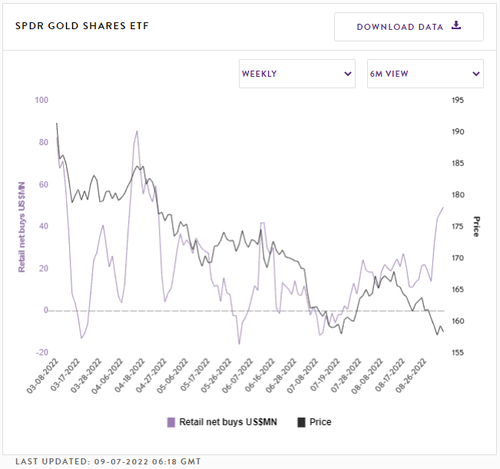

So could a rush for the safe havens foreshadow better times ahead? Vanda thinks so, noting that the recent rout in financial markets has pushed retail investors towards bonds and gold, driving a change in their short-term purchasing pattern. As frequently noted, retail investors’ bias is predominantly contrarian when it comes to risky assets. Conversely, this investor cohort tends to momentum-trade safe havens such as bonds and gold. So, the jump in purchases for these havens – off the back of price declines - indicates an increasingly bearish shift in sentiment. When considering retail’s ‘late-to-the-party’ track record in timing bottoms, this could actually foreshadow an improving outlook for equities in the days ahead.

More in the full note available to pro subscribers.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.