SOURCE:

"An Ocean Of Red..." | ZeroHedge

Everyone was so sure, so confident, and then boom, CPI printed way hotter than expected...

...and the soft-landing dream was over...

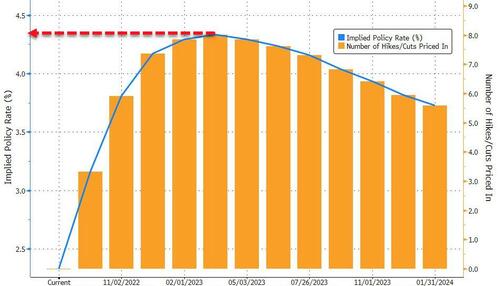

While markets turmoiled dramatically, it was the STIRs that highlight the major shift.

The odds of a 100bps next week soared to 47%, the odds of a 75bps hike in November jumped to 60%, and the odds of a 100bps hike in December spike to 50%...

Source: Bloomberg

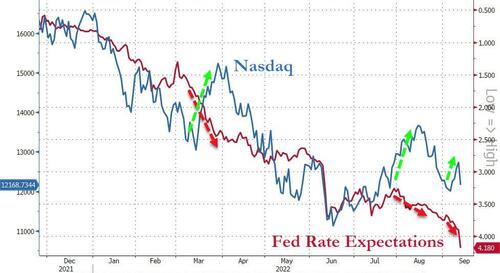

All of this sent rate-hike expectations for year-end massively higher (actually the biggest jump in history)... and at the same time saw the implied odds of that sparking a recession surge as expectations for subsequent rate-cuts jumped dramatically too...

Source: Bloomberg

The terminal rate for Fed rates is now just below 4.33% in April 2023...

Source: Bloomberg

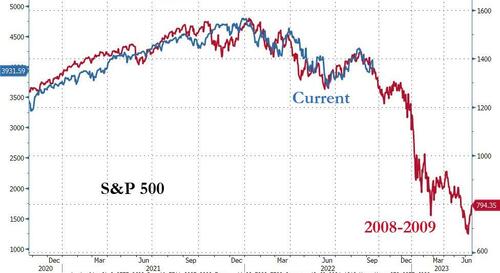

All of which erased much of the last week's squeeze-driven surge higher in stocks...The Dow has lost ALL of its gains from the last week's squeeze...

"Aaand it's gone!"

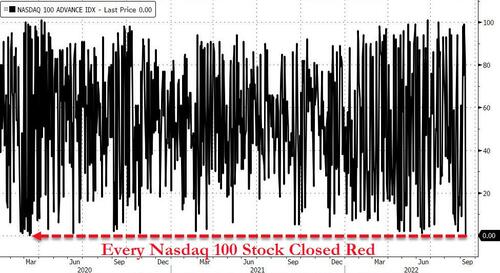

Nasdaq was the day's biggest loser, down over 5% - its worst day since March 2020... The Dow's 1200 point loss was the worst day since June 2020...

For the first time since March 2020, every Nasdaq 100 stock closed red...

One day after AAPL's best day since May, it suffered its worst day since May...

As the short squeeze of the last few days abruptly ended...

Source: Bloomberg

And all the US Majors crashed back below key technical levels (50DMAs)...

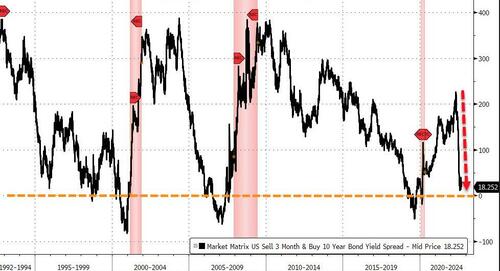

Bonds were a bloodbath today with the short-end monkeyhammered most...

Source: Bloomberg

Which sent the yield curve dramatically flatter - with the infamous 'last hope standing' 3M10Y spread plunging towards inversion...

Source: Bloomberg

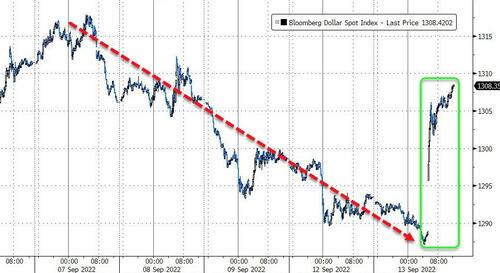

The dollar ripped higher, erasing much of the last few days' 'dovish'-hope weakness...

Source: Bloomberg

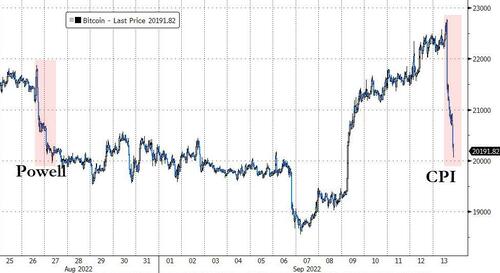

Cryptos were clubbed like a baby seal with Bitcoin puking from over $22500 to almost $20000 (down over 10% - its worst drop since the June collapse)...

Source: Bloomberg

Spot gold puked back below $1700 but found support there again...

Source: Bloomberg

But, after the Biden admin said it was mulling refilling the SPR, oil prices rallied and almost made it into positive territory on the day...

Finally, it's catch-down time for stocks once again as tightening expectations slam reality back into the hope-filled face of stocks...

Source: Bloomberg

And bear in mind that we have a $3.2 trillion options expiration on Friday just as the buyback blackout window is closing - brace!

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.